Introduction:

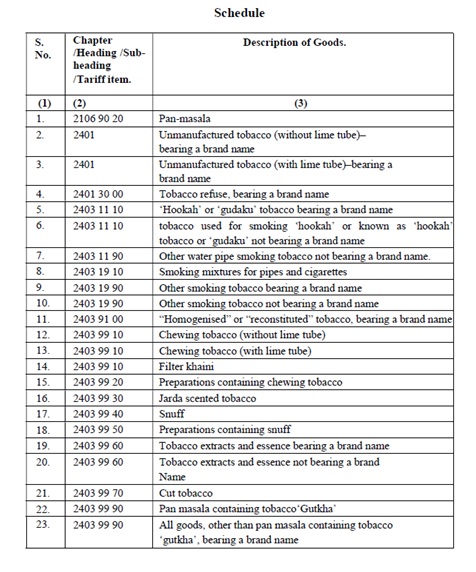

In a bid to bolster transparency and regulatory control in the manufacturing sector, the Central Government, leveraging the authority vested in it by section 148 of the Central Goods and Services Tax Act, 2017, has introduced a pivotal notification. Set to be enforced from April 1, 2024, this directive delineates a specialized procedure for registered individuals involved in manufacturing specific goods.

Details of Packing Machines (FORM GST SRM-I):

A core provision of this notification centers around the mandatory reporting of packing machine details. Manufacturers engaged in producing goods specified in the attached Schedule must electronically submit information on the common portal within thirty days of the notification’s enactment.

For those granted registration post-notification issuance, a tighter timeline of fifteen days from registration approval is stipulated for submitting packing machine details. Furthermore, any additions or modifications to the packing machinery setup must be promptly reported within twenty-four hours on the common portal.

Unique Registration Numbers and Capacity Declarations:

Upon submission of details in FORM GST SRM-I, a unique registration number will be generated for each packing machine. This facilitates streamlined tracking and ensures a comprehensive overview of the machinery employed in manufacturing.

In addition, if a registered person has previously submitted production capacity details to other government departments or organizations, these must be furnished in Table 7 of FORM GST SRM-I within fifteen days of filing the declaration or submission. For those who provided such details before the issuance of this notification, the latest certificate must be submitted within thirty days of the notification release.

Special Monthly Statement (FORM GST SRM-II):

Manufacturers must adhere to the new reporting structure by submitting a special monthly statement electronically on the common portal. This statement, due on or before the tenth day of the month following production, ensures a regular and systematic overview of manufacturing activities.

Certificate of Chartered Engineer (FORM GST SRM-III):

A noteworthy addition to the procedure is the requirement for a certificate of Chartered Engineer (FORM GST SRM-III) for machines declared in FORM GST SRM-I. This certification, initially uploaded for each machine, must be updated if any details are subsequently amended.

Conclusion:

The introduction of this GST notification marks a significant stride toward standardizing reporting and ensuring compliance within the manufacturing sector. By placing emphasis on packing machine details, monthly statements, and certification processes, the government aims to foster a more transparent and accountable manufacturing environment. As businesses adapt to these changes, the industry can expect greater efficiency and regulatory adherence.