Property sale by Non-Resident Indians (NRIs) and Overseas Citizen of India (OCIs) in India is a common transaction. In this regard, NRIs often seek various tax and legal services related to the sale of their property. One of the first services NRIs look for is obtaining a Lower TDS Certificate or Nil TDS deduction Certificate (Form 13 Application) from the Income Tax Department in various cities in India, such as Gurgaon, Delhi, Faridabad, and other parts of India.

A. Rate of TDS on Property selling by NRI

As per Indian Tax Laws, TDS provisions apply to various financial transactions in India, including Property Sale Transactions. If the seller is a:

- Resident Indian: TDS rate is 1% and governed by section 194IA. Or

- Non-Resident: TDS is governed by Non-Resident TDS provisions i.e. section 195. Under the Non-Resident TDS Provisions i.e. Section 195, TDS rates apply at the maximum rates on the Sale amount of Property.

- Long-term capital assets: The rate is 12.50% if the property is a long-term capital asset if the property is sold by NRI and

- Short-term capital assets: if the property is a short-term capital asset tax slab rate will apply.

Additional surcharge and 4% cess apply.

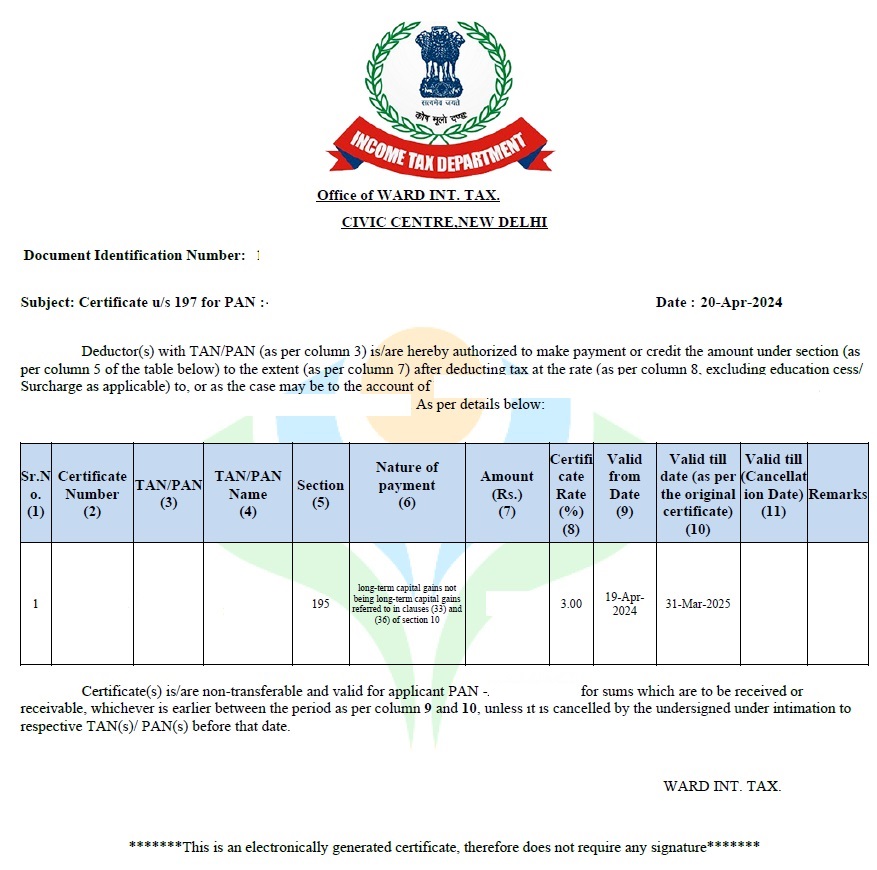

B. Lower TDS Certificate or Nil TDS Certificate

In many cases, the actual tax liability of the non-resident seller is lesser than the proposed TDS on that transaction, resulting in a genuine hardship for the seller. To overcome this situation, the Income Tax Act provides for a Lower TDS certificate or Nil TDS Certificate for NRI (or also called as TDS Exemption Certificate) under section 197 of the Income Tax Act.

To seek relief in the withholding tax rates, NRIs can apply for a Lower TDS Certificate (TDS exemption certificate) with the Jurisdictional Income Tax Authority. This application is filed in Form 13. It is an online application process, and the applicant needs to prepare and arrange various supporting documents for this Lower TDS Certificate for NRI. All the documents are submitted along with the application Form 13 which is filed online.

On receipt of the Lower TDS Certificate for NRI (or TDS exemption certificate), the buyer deducts the TDS as per the rate given in the certificate. This process allows NRI to get TDS relief before the sale transaction and avoid blocking of their money with the Income Tax Department.

C. Documents Required for Lower TDS Certificate or Nil TDS Certificate

In this regard, while the list of documents required varies depending on the transaction and other facts of the non-resident and property, the following is a standard list of documents and information that are generally required for the preparation of a Lower TDS Certificate Application:

- Income Tax Login Details of NRI/Foreign Citizen. If not created then need to be created

- Registration on the Lower TDS Application Portal i.e. TRACES (For Filing Form 13 online)

- Agreement To Sell With Buyer (For Sale of Property)

- TDS Account Number (TAN) & TAN Letter of Property Buyer. Buyers can apply online and they can get in 3-4 days by filing Form 49B with Income Tax Department.

- Copy of Passport of NRI

- Circle value of the property being sold (documentary evidence or website reference)

- Property Acquisition & Purchase related documents (i.e. Sale Deed, Agreement with Builder, Allotment Letter, etc)

D. Submission Mode of Lower TDS Certificate for NRI

To request a certificate for a lower TDS certificate for NRI or no deduction at all, an NRI must submit an application using Form No. 13 electronically. This can be done through two methods:

1) using a digital signature or

2) via electronic verification code. The application falls under sub-section (1) of section 197.

E. Validity Period of Lower TDS Certificate For NRI

The validity period of the certificate issued for a lower TDS certificate for NRI or no deduction at all will be determined by the period specified in the certificate unless it is cancelled by the Assessing Officer before the expiry of that period. The lower TDS certificate is valid only for the specified period in the previous year.

F. Whom Lower TDS Certificate is Issued

The lower TDS certificate for NRI or no deduction at all will be issued to NRI, addressing the buyer of the property responsible for deducting the tax. The NRI who applied for the certificate will be given the lower TDS certificate.

For example, if John applied for a Lower TDS certificate, the certificate will be issued directly to John, and the buyer who is responsible for deducting his TDS will be notified that the certificate has been issued.

G. Time Limit for Applying Lower TDS Certificate for NRI

There is no time limit specified under the income tax act 1961. Practically, the NRIs apply for a lower TDS certificate at least 30-40 days before selling of property.

H. Benefits of Lower TDS Certificate for NRI

Obtaining a lower TDS (Tax Deducted at Source) certificate can provide several benefits for Non-Resident Indians (NRIs), including:

- Reduced tax liability: With a lower TDS certificate for NRI, NRIs can ensure that the tax deducted on their income is at a reduced rate. This can result in lower tax liability and more take-home income.

- Improved cash flow: NRIs can avoid overpaying taxes and can have improved cash flow by obtaining a lower TDS certificate. This can help them manage their finances more efficiently.

- Faster income tax refunds: With a lower TDS certificate, NRIs can ensure that the right amount of tax is deducted, and they are not overtaxed. This can result in faster tax refunds as they will have paid the correct amount of tax.

- Simplified income tax filing: NRIs with a lower TDS certificate can file their tax returns more easily and accurately as they will have paid the correct amount of tax during the year.

Overall, obtaining a Lower or Nil TDS certificate for NRI can provide significant financial benefits for NRIs and can help them manage their tax obligations more effectively.

I. Choose Our Lower or Nil TDS Certificate Services

As an NRI tax consultant, we assist Non-Resident Indians (NRIs) with their tax obligations and compliance requirements. NRIs are individuals who reside outside of India for a specified period, but still hold Indian citizenship. As an NRI, they have certain tax obligations in both their country of residence and India.

As an NRI tax consultant, we help NRIs understand their tax liability, file income tax returns, and ensure that they are in compliance with both Indian and foreign tax laws. We assist with the preparation and filing of Indian tax returns, including the calculation of taxes owed, identifying tax exemptions and deductions, and ensuring that all necessary documents are in order.

In addition, we also provide advice and guidance on tax planning for NRIs, including tax-efficient investment strategies and the optimal structuring of financial assets. We also advise on the tax implications of repatriating funds to India and help NRIs navigate the complex rules and regulations related to foreign exchange and currency conversions.

We welcome your inquiries and can be reached via email at mail@nbaoffice.com

Here is the Format of Lower TDS certificate generated for NRI

Read Blogs on Selling of Property by NRI:

a) This Ruling Will Help NRI Selling Immovable Property and Receiving Sale Consideration in Cash