GST Registration

GST registration is an important step for the person starting a business in India. Taking GST registration can be a voluntary decision or a mandatory provision as per the GST law. There are provisions under which a person is liable to register his business under the GST law and no exemption is provided. Also, there are exemptions under which a person is not liable to take GST registration. The provisions and the person liable and not liable to take GST registration have been provided below and discussed in depth. With this detailed content, we will try to make it easy for you to decide whether you should take GST registration or not. After reading this content if you still have doubts, you can raise your query at mail@naboffice.com. Our team of professionals will simplify your doubt and assist you in taking GST registration.

The Goods and services tax act has come into effect on 1st July 2017 and it incorporated various chapters related to GST returns, GST registration, Place of Provision of goods and services, Time of supply of goods and services and GST assessment proceedings. The chapters include provisions in relation to GST registration which contains the provision relating to exemption from GST registration, the person liable for GST registration and person not liable to take GST registration.

GST registration is completely an online process, where a person has to fill in the details of proprietor/partners/directors and detail of the place of business. After completing the form and uploading the mandatory documents, the application must be completed with Aadhar authentication. If all the filled details and attached documents are complete in all respect and the proper officer is satisfied with applicant’s details then GST registration number is allotted.

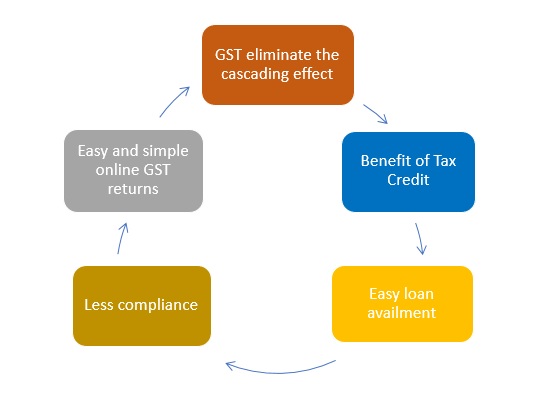

Benefits of GST Registration

There are a few benefits that every businessman and startup should know.

- GST eliminate the cascading effect. This means a person who is registered under the GST law can take input tax credit of goods and services purchased from suppliers. So, the tax on tax is eliminated by taking GST registration.

- Benefit of input tax credit (ITC) of inward supply of goods and services.

- Loan from banks and financial institutions are easily available

- Less compliance as compared to previous VAT law.

- Easy and simple online GST returns filing procedure

Person liable to obtain GST registration

Section 22(1) of CGST act specifies that every person whose aggregate turnover in a financial year exceeds Rs. 20 lakhs is liable to get registered under the GST act. In special categories state turnover limit is Rs.10 lakhs. The limit of Rs.20 lakhs has been increased to Rs.40 lakhs where a person exclusively deals in goods. So, if you are dealing in service then limit of Rs.40 lakhs will not be available to you.

For Example: Mr. Adani deals in the supply of services in gurgaon. His total aggregate turnover is Rs. 38 lakhs during the current financial year. is he liable to obtain GST registration in gurgaon?

An exemption limit of Rs. 40 lakhs apply in case of a person dealing in goods. Mr Adani is dealing in supply of services. Hence, he is liable to register himself under the GST act.

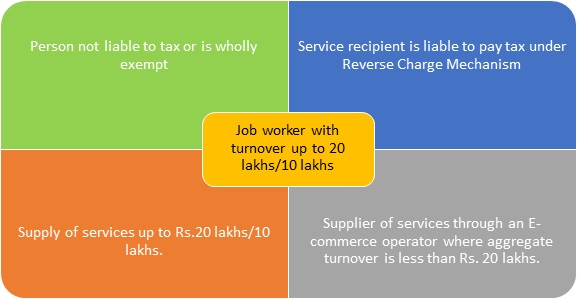

Persons not liable for GST Registration

- A Person not liable to tax or is wholly exempt from the tax does not require to get GST registration.

- Service recipient is liable to pay tax under reverse charge mechanism (RCM), then the service provider is not required to take GST registration.

- Job worker with turnover up to 20 lakhs/10 lakhs is exempt even if supply to a registered person is inter-state.

- Supply of services including inter-state supply up to Rs.20 lakhs/10 lakhs.

Person liable for compulsory GST registration

In the following case limit of 10/20/40 lakhs does not apply and the person has to take GST registration mandatory.

- A supplier making inter supplies of goods

- Casual taxable person making taxable supply

- Person required to make payment tax under reverse charge mechanism (RCM).

- Non-resident making taxable supply.

- Person liable to deduct TDS under section 51.

- E-commerce operator require to collect tax at source (TCS) under section 52

- A person supplies goods or services or both on behalf of other taxable person, whether as an agent or otherwise.

- Input service distributor.

- A person supplies goods or services or both, other than the supplies given u/s 9(5), through e-commerce operator who is required to collect tax at source u/s 52.

- A person supplies Online Information Database Access and Retrieval services (OIDAR) from a place outside India to a person in India, other than registered taxable person.

Information and Documents required for GST Registration

| GST Registration for Individual/Proprietor | GST Registration for Private Limited or Limited Company | GST registration for Limited Liability Partnership (LLP) |

| 1. PAN Number of Proprietor 2. Name of Proprietor as mentioned in PAN 3. Email ID 4. Phone Number 5.Trade Name 6. Type of Registration (Voluntary, Casual, etc…) 7. Existing Registration (like IEC, VAT, or any other state and central registration) 8. Promoter Details a. Name of the person b. Fathers Name c. Date of Birth d. Mobile Number e. Email ID f. Citizenship 9. Details of Principal Place of business a. Address of the premises* b. Nature of possession (Rented, leased, or owned)** c. Nature of Business activity carried out 10. Additional place of business if any 11. Details of Goods/ Commodities supplied by the business 12. Number of Bank accounts maintained 13. State-specific information a. Professional Tax Employee code (EC) no. b. Professional Tax Registration no. c. State Excise License no. | 1. PAN No of Company 2. Name of company as mentioned in PAN 3. Email ID 4. Phone No 5. Trade Name 6. Type of Registration (Voluntary, Casual, etc…) 7. Certificate of Incorporation of the company 8. Memorandum of Association 9. Articles of Association 10. Director’s Details a. Name of the person b. Fathers Name c. Date of Birth d. Mobile Number e. Email ID f. Citizenship 11. Board Resolution to authorize person for GST compliance 12. Details of Principal Place of business a. Address of the premises* b. Nature of possession (Rented, leased, or owned)** c. Nature of Business activity carried out 13. Additional place of business if any 14. Details of Goods/ Commodities supplied by the business 15. Number of Bank accounts maintained 16. State-specific information a. Professional Tax Employee code (EC) no. b. Professional Tax Registration no. c. State Excise License no. | 1. PAN Number of LLP 2. Name of LLP as mentioned in PAN 3. Email ID 4. Phone No 5. Trade Name 6. Type of Registration (Voluntary, Casual, etc…) 7. Certificate of Incorporation of the LLP 8. LLP Deed 9. Partners’ Details a. Name of the person b. Fathers Name c. Date of Birth d. Mobile Number e. Email ID f. Citizenship 10. Authorization letter to authorize person for GST compliance 11. Details of Principal Place of business a. Address of the premises* b. Nature of possession (Rented, leased, or owned)** c. Nature of Business activity carried out 12. Additional place of business if any 13. Details of Goods/ Commodities supplied by the business 14. No. of Bank accounts maintained 15. State-specific information a. Professional Tax Employee code (EC) no. b. Professional Tax Registration no. c. State Excise License no. |

* For address-proof of the premises’ Electricity Bill, Water Bill, Property Tax Receipts, Sale Deed, or any other ownership proof.

** In case ownership is not in the name of the proprietor NOC from owner is required

FAQs on GST Registration

Question: Do I need to submit hard copy of documents at GST office?

Answer: No, GST registration is a paperless process. All documents are submitted online.

Question: When do I need to take GST registration?

Answer: Within 30 days from the date you become liable. In case of a Casual Taxpayer or Non-resident taxable person, 5 days prior to the commencement of the business

Question: Can I take 2 GST registration within a same state?

Answer: Yes, You can take 2 GST registrations in a state when you have a business requirement, however you can add your branch office as an additional place of business.

Question: I don’t have PAN, how can apply GST number

Answer: It I mandatory to have PAN for GST registration because GST registration number is PAN based.

Question: Whose e-mail ID and mobile number should I give?

Answer: You can give details of the Primary Authorised Signatory

Question: What is a TRN?

Answer: TRN or Temporary Reference Number is a unique 15-digit reference number that allows you to access your new registration application on the GST Portal in the pre-login mode (without valid login credentials).

Question: Are you a citizen of India?

Answer: If you select NO, passport details will become mandatory and PAN details will become optional

Question: Is digital signature mandatory for submit GST Registration application:

Answer: GST registration in Gurgaon is completely paperless and online process, however, the note Digital signature is mandatory for (i) Public Limited Company, (ii) Private Limited Company, (iii) Unlimited Company; (iv) Foreign Company; (v) LLP; (vi) Foreign LLP; (vii) Public Sector Undertaking.

Question: Do I need a PAN to obtain a temporary registration as a Non-Resident Taxable Person?

Answer: No, PAN is not mandatory for obtaining temporary registration as a Non-Resident Taxable Person however, you must have an authorised signatory who is an Indian citizen with a valid PAN card.