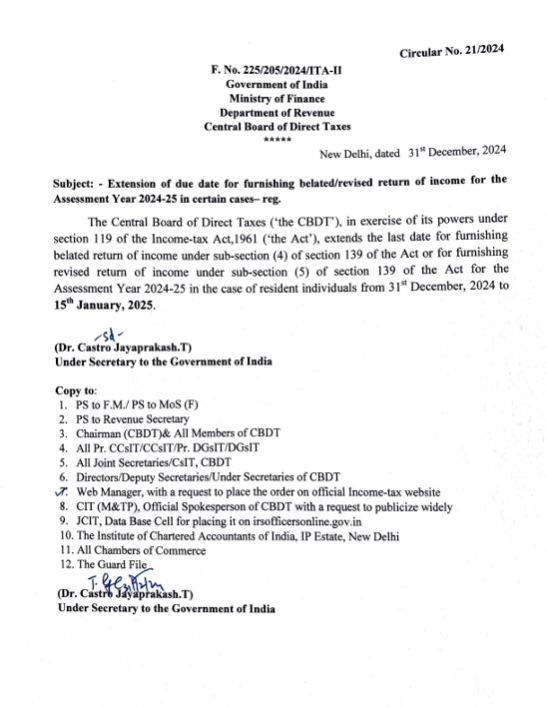

The Central Board of Direct Taxes (CBDT) has provided relief to individual taxpayers by extending the deadline for filing Belated and Revised Income Tax Returns (ITRs) for the Assessment Year 2024-25. The new deadline for Resident Individuals is now 15th January 2025, a significant extension from the earlier date of 31st December 2024.

Key Highlights of the Extension:

- Extension Applicable Only for Individuals:

- The relief is limited to individual taxpayers. Entities such as Hindu Undivided Families (HUFs), private limited companies, Limited Liability Partnerships (LLPs), and others are not covered under this extension.

- These entities must adhere to the original deadline of 31st December 2024 for filing their ITRs.

- Restricted to Resident Individuals:

- The extension applies solely to Resident Individuals.

- Non-resident individuals are required to file their Belated or Revised Returns by 31st December 2024 and are not eligible for this extended timeline.

- Covers Both Belated and Revised Returns:

- The extension provides additional time for Resident Individuals to file both Belated and Revised Returns for AY 2024-25.

Implications for Taxpayers:

The extension offers a breather to Resident Individuals who may have missed the original deadline or need to revise their filed returns. However, it’s essential for other taxpayer categories, including non-residents and business entities, to remain vigilant and ensure compliance with the original timeline to avoid penalties or interest charges.

Final Note:

This decision by the CBDT reflects a targeted approach to provide relief to specific taxpayer segments, emphasizing the importance of timely compliance for others. Taxpayers are advised to plan their filings accordingly to avoid last-minute stress.

Stay updated and ensure you don’t miss critical deadlines for your ITR filing!