About Lower TDS Deduction Certificate

The sale of property by Non-Resident Indians (NRIs) and Overseas Citizen of India (OCIs) in India is a common transaction that often involves seeking tax and legal services. One of the first services that NRIs seek is obtaining a Lower TDS Certificate or Nil TDS deduction Certificate (Form 13 Application) from the Income Tax Department. This certificate allows NRIs to receive relief from high withholding tax rates and avoid blocking their money with the Income Tax Department.

A. Rate of TDS on Property selling by NRI

Under Indian tax laws, TDS provisions apply to various financial transactions, including property sale transactions. If the seller is a

- Resident Indian: The TDS rate is 1% and governed by section 194IA.

- Non-Resident: TDS is governed by Non-Resident TDS provisions, i.e., section 195. Under these provisions, TDS rates apply at the maximum rates on the sale amount of property. if the property is a:

- Long-term capital asset: When an NRI sells a long-term capital asset, the applicable rate is 12.50 per cent (without indexation) if transfer takes place on or after July 23, 2024.

- Short-term capital asset: Where the NRI sells property which is considered a short-term capital asset then the slab rate will apply on the capital gain.

It is important to note that an additional surcharge and 4% Cess also apply to the capital gain. The effective rate of TDS on sale of property by NRI in case of Long Term Capital Gains would be as follows:

| Particulars | Property Sale Price (Rs.) Less than 50 Lakhs | Property Sale Price (Rs) 50 Lakhs to 1 Crores | Property Sale Price (Rs.) 1 Crores to 2 Crores | Property Sale Price (Rs.) 2 Crores to 5 Crores | Property Sale Price more than (Rs.) 5 Crores | |

| Long Term Capital Gains Tax | 12.50% | 12.50% | 12.50% | 12.50% | 12.50 | |

| (Add) | Surcharge | Nil | 10% of above | 15% of above | 25% of above | 37% of above |

| Total Tax (including Surcharge) | 12.50% | 13.75% | 14.375% | 15.6250% | 17.125% | |

| (Add) | Health & Ed. Cess | 4% of above | 4% of above | 4% of above | 4% of above | 4% of above |

| Applicable TDS Rate (incl. Surcharge & Cess) | 12.50% | 14.30% | 14.95% | 16.25% | 17.81% |

B. Lower TDS Certificate or Nil TDS Certificate

In many cases, the actual tax liability of the non-resident seller is lesser than the proposed TDS on that transaction, resulting in a genuine hardship for the seller. To overcome this situation, the Income Tax Act provides for a Lower TDS certificate or Nil TDS Certificate for NRI (or TDS Exemption Certificate) under section 197 of the Income Tax Act.

To seek relief in the withholding tax rates, one can apply for a Lower TDS Certificate for NRI or Nil TDS Certificate (TDS exemption certificate) with the Jurisdictional Income Tax Authority. This application is filed in Form 13, which is an online application process. The applicant needs to prepare and arrange various supporting documents for this Lower TDS Certificate for NRI. All the documents are submitted along with the application Form 13.

The buyer deducts the TDS as per the rate given in the certificate on receipt of the Lower TDS Certificate for NRI (or TDS exemption certificate). This process allows NRI to get TDS relief before the sale transaction and avoid blocking of their money with the Income Tax Department. It is important for the buyer, purchasing an immovable property from an NRI seller that, the Lower TDS certificate specifies only a lower rate of Tax, it does not give relief from Surcharge and Cess. Hence buyers should be very cautious about that rate of TDS. He should deduct the TDS on the rate specified on the lower TDS Certificate and add Surcharge and Cess.

C. Documents Required for Lower TDS Certificate or Nil TDS Certificate

The list of documents required for the preparation of a Lower TDS Certificate for NRI Application varies depending on the transaction and other facts of the non-resident and property. However, the following is a standard list of documents and information that are generally required for a lower TDS certificate for NRI or Nil TDS certificate:

- Income Tax Login Details of NRI/Foreign Citizen (if not created then need to be created)

- Registration on the Lower TDS Application Portal, i.e., TRACES (for filing Form 13 online)

- Agreement to Sell with Buyer (for sale of property)

- TDS Account Number (TAN) and TAN Letter of Property Buyer. Buyers can apply online, and they can get it in 3-4 days by filing Form 49B with the Income Tax Department.

- Copy of Passport of NRI

- Circle value of the property being sold (documentary evidence or website reference)

- Property Acquisition and Purchase related documents (i.e., Sale Deed, Agreement with Builder, Allotment Letter, etc.)

We welcome your inquiries and can be reached via email at mail@nbaoffice.com

D. Submission Mode of Lower TDS Certificate for NRI

To request a certificate for a lower TDS certificate for NRI or Nil deduction at all, an NRI must submit an application using Form No. 13 electronically. This can be done through two methods:

- using a digital signature or

- via electronic verification code.

E. Validity Period of Lower TDS Certificate For NRI

When a certificate is issued for a lower TDS (tax deducted at source) or Nil deduction of TDS for NRIs (non-resident Indians), its validity period will be determined by the duration mentioned in the certificate itself. However, if the Assessing Officer cancels the certificate before its expiry, it becomes invalid. It is essential to note that the certificate is only valid for the specified period in the previous year, and it cannot be carried forward to future years.

F. To Whom is Lower TDS Certificate Issued

When a person applies for a lower TDS certificate for NRI or Nil deduction certificate (or TDS Exemption Certificate), it will be issued to the NRI by the Indian Income Tax Department. The certificate will be addressed to the buyer of the property, who is responsible for tax deduction at the time of payment to the NRI.

The lower TDS certificate will enable the buyer to deduct tax at a lower rate than the regular TDS rate. If a no-deduction certificate is issued, the buyer can skip the TDS deduction altogether. It is important to note that the NRI who applied for the certificate will receive the lower TDS certificate, and it will be their responsibility to furnish it to the buyer.

G. Time Limit for Applying Lower TDS Certificate for NRI

As per the Income Tax Act 1961, there is no specific time limit mentioned to apply for a lower TDS certificate for NRIs (non-resident Indians). However, in practice, it is advisable to apply for the certificate at least 30-40 days before selling the property. This allows sufficient time for the application process, verification, and issuance of the certificate.

Our Professional firm specializing in such services typically takes around 15-20 days to complete the formalities and obtain the lower TDS certificate for NRI (or TDS Exemption Certificate). The lower TDS certificate enables the NRI to pay tax at a reduced rate, and in some cases, it exempts them from paying any tax.

We welcome your inquiries and can be reached via email at mail@nbaoffice.com

H. Benefits of Lower TDS Certificate for NRI

For NRIs (non-resident Indians), selling property in India can be a challenging process due to various regulatory and taxation requirements. One such requirement is tax deduction at source (TDS) on the sale proceeds of the property. However, NRIs can benefit from a lower TDS certificate or Nil TDS Certificate (or TDS Exemption Certificate), which can significantly reduce their tax liability. Let’s take a look at the benefits of the lower TDS certificate for NRIs or Nil TDS Certificate:

- Reduced Tax Liability: The primary benefit of the lower TDS certificate for NRIs is a reduction in tax liability. Typically, TDS is deducted at a rate of 12.50% of the sale proceeds for long-term capital assets and a Slab rate for short-term capital assets. However, with the lower TDS certificate (or TDS Exemption Certificate), NRIs can avail of a lower tax rate or Nil tax rate, which can be as low as 0% for long-term capital assets or short-term capital assets.

- Quicker Refunds: In the absence of the lower TDS certificate for NRI, NRIs may have to pay a higher tax rate than required, which could lead to an excess TDS deduction. This results in a refund claim process, which can take considerable time to complete. However, with the lower TDS certificate, NRIs can avoid over-deduction of TDS, leading to quicker refunds.

- Time-Saving: Obtaining a lower TDS certificate for NRI can save a considerable amount of time and effort. The certificate can be obtained by submitting an application and supporting documents to the Indian Income Tax Department. Professional CA firms in Gurgaon and Faridabad specializing in such services can also help NRIs obtain the certificate quickly and efficiently.

- Compliance: NRIs can ensure compliance with Indian taxation laws by obtaining the lower TDS certificate. The certificate ensures that the tax liability is paid correctly, and there is no risk of non-compliance or legal consequences.

In conclusion, the lower TDS certificate for NRIs can significantly benefit by reducing their tax liability, leading to quicker refunds, avoiding double taxation, saving time and effort, and ensuring compliance with Indian taxation laws. NRIs can consider obtaining the lower TDS certificate (or TDS Exemption Certificate) to streamline the tax payment process and minimize their tax burden on the sale of property in India.

Choose Our Lower or Nil TDS Certificate Services

If you are an NRI planning to sell your property in India, you can benefit from our lower or nil TDS certificate services. We are a CA (Chartered Accountant) firm based in Gurgaon and Faridabad, specializing in taxation services for NRIs.

Our services are designed to help NRIs streamline the tax payment process and minimize their tax liability on the sale of property in India. Here are some reasons why you should choose our lower or nil TDS certificate services:

- Expertise: Our team of experienced and knowledgeable tax professionals has in-depth knowledge of Indian taxation laws and regulations. We can guide you through the process of obtaining a lower or nil TDS certificate for NRI and ensure compliance with all applicable regulations.

- Timely Service: We understand the importance of time when it comes to obtaining a lower or nil TDS certificate. We strive to provide timely and efficient services to ensure that you have the certificate well before the sale of your property.

- Customized Services: We offer customized services to meet your specific requirements. Whether you need a lower TDS certificate for a long-term or short-term capital asset, or a nil TDS certificate for exemption from tax liability, we can tailor our services to meet your needs.

- Transparent Pricing: We offer transparent pricing for our services with no hidden charges. We provide upfront quotes and ensure that there are no surprises or unexpected costs.

- Client-Focused Approach: Our services are designed to provide maximum value to our clients. We prioritize client satisfaction and ensure that our services are tailored to meet their specific needs.

If you are an NRI planning to sell your property in India, our lower or nil TDS certificate services can help you minimize your tax liability and streamline the tax payment process. We are a CA firm in Gurgaon and Faridabad with expertise in taxation services for NRIs. Contact us today to learn more about how we can help you.

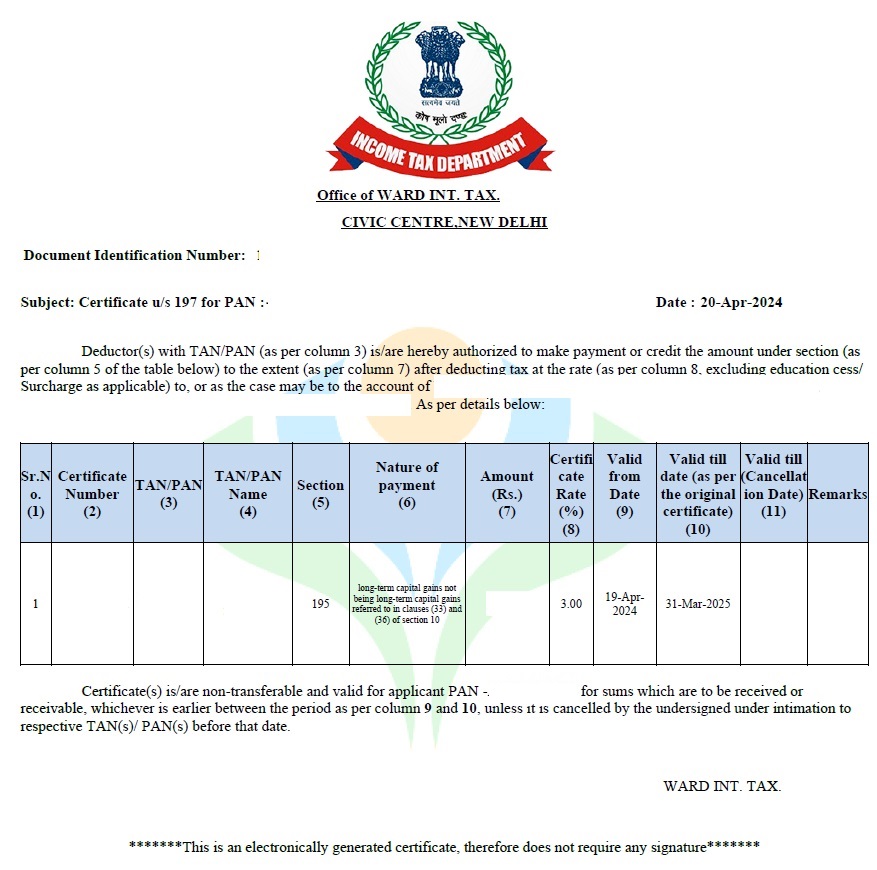

Here is the format of the Lower TDS certificate for NRI generated by the income tax department:

We welcome your inquiries and can be reached via email at mail@nbaoffice.com

Read Blogs on Selling of Property by NRI:

a) This Ruling Will Help NRI Selling Immovable Property and Receiving Sale Consideration in Cash